In January, President Biden announced a pause on pending decisions for increased liquefied natural gas (LNG) exports. The pause affects countries that do not have a free trade agreement with the United States, which are where most LNG exports go.

The economic, environmental, and national security reasons for expanding LNG exports are strong. Restricting LNG exports will reduce economic growth and job creation, while increasing exports would help America’s European allies end their dependence on dirtier Russian gas. More fundamentally, the Biden administration is politicizing a decision that should be left to the market. The administration should end the pause immediately, and Congress should remove the federal authority to make national interest determinations for LNG exports.

The Economic and Environmental Importance of LNG

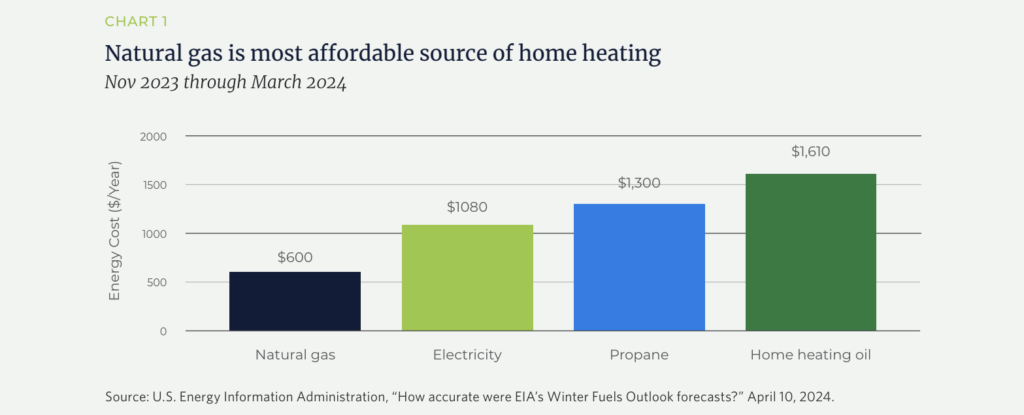

With abundant reserves and innovative production methods encouraged by its free-market system, the U.S. has ascended to become the world’s largest natural gas producer. In fact, natural gas will likely soon overtake petroleum as the nation’s primary source of energy consumption. The benefits of the growth in natural gas supplies have accrued to families and businesses in numerous ways, most notably through lower energy bills.

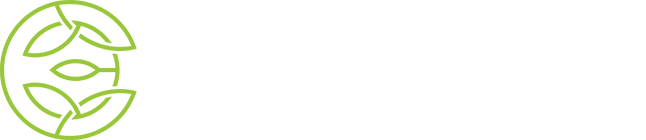

A 2019 White House Council of Economic Advisors analysis found that from 2007-2019, lower natural gas prices saved a family of four $2,500 annually. The savings are particularly beneficial for low-income households who spend a higher percentage of their budget on energy bills. While many factors impact regional and local electricity bills, the U.S. Energy Information Administration (EIA) notes that natural gas prices “were the most uniform contributor to reduced wholesale electricity prices across regions in 2023.” While a mild winter shielded many households from skyrocketing energy bills, those relying on natural gas saved the most.

Dependable, affordable natural gas has unlocked economic opportunity and made the U.S. a more attractive place to invest. Natural gas is a valuable resource and feedstock for manufacturing, agriculture production and other energy-intensive businesses, which has generated significant investment. In the chemical industry alone, which is the single largest consumer of natural gas, investments linked to the shale fracking revolution have surpassed $200 billion.

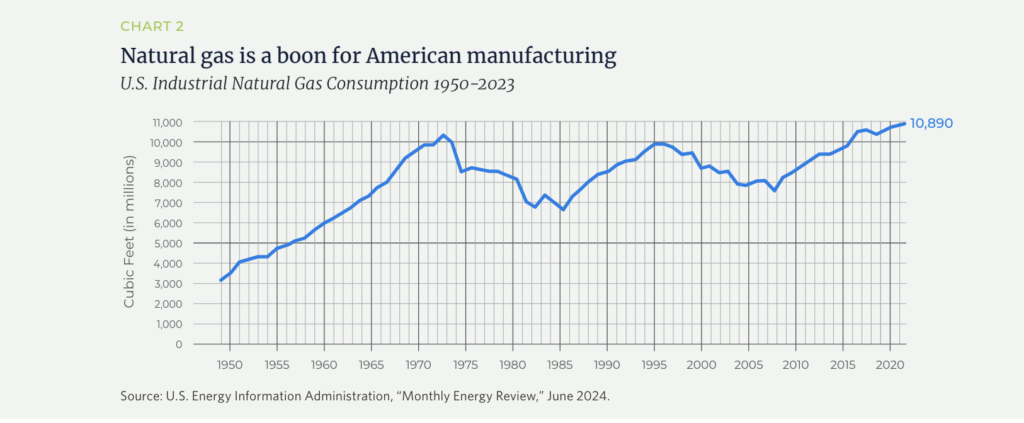

More natural gas consumption has generated significant environmental benefits as well. Natural gas is cleaner burning than coal and produces less particulate matter, sulfur dioxide, and nitrous oxide emissions, which has improved air quality and public health. One study in Nature Sustainability estimates that coal-to-gas switching in power generation from 2005-2016 saved more than 22,000 lives because of the local health benefits.

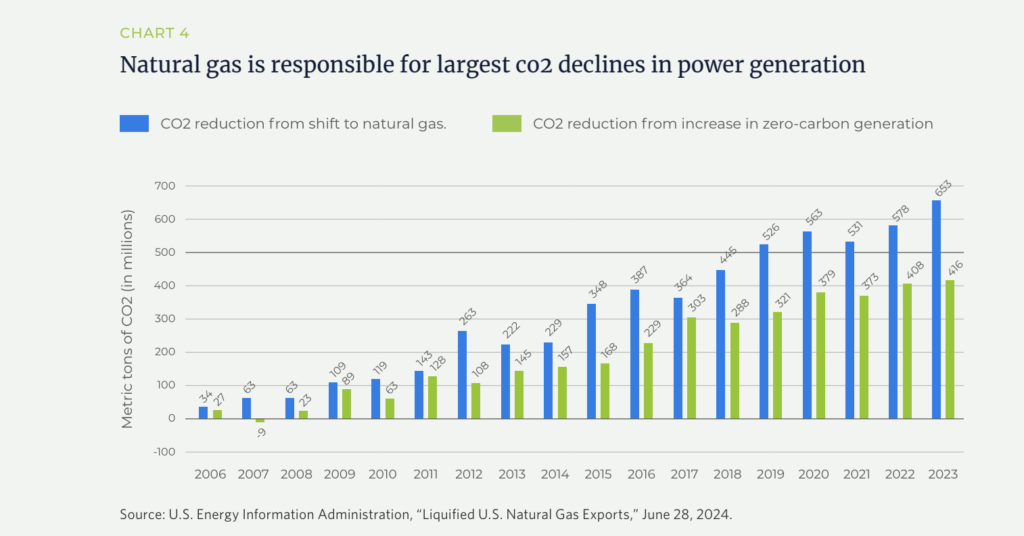

Increased natural gas usage has exemplified many of the traits necessary for climate progress to be durable. Cost-effective innovations and investments that improve human welfare, boost productivity, and make lives more convenient will be the ones that most successfully reduce global emissions. Decoupling economic growth from emissions must be the path forward for developed countries and emerging economies. Increased natural gas production is primarily responsible for America’s global leadership in economy-wide emissions reductions. Since 2005, natural gas has contributed to 61 percent of the decline in electricity sector emissions in the U.S.

LNG is a National Security Asset

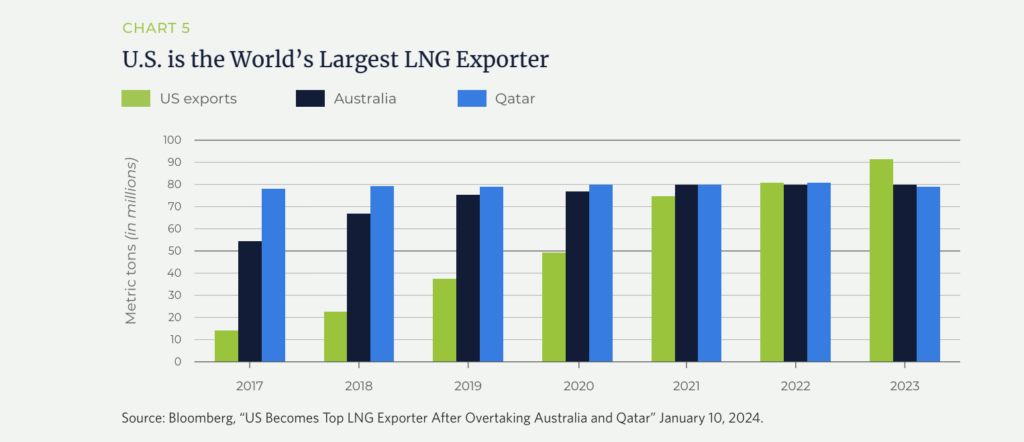

Enhancing energy security has long been a priority of U.S. energy policy, although overall policy choices have delivered only mixed results. While reducing dependence on American adversaries is a laudable goal, too often policy conversations have promoted energy self-sufficiency. Worse still, policy actions have mandated or subsidized fuels such as ethanol, which burdens taxpayers and energy consumers but provides few if any national security benefits. Conversely, policies that open markets diversify supplies and reduce the ability of any nation or entity to manipulate markets for political purposes. America’s ascension to the world’s top LNG exporter is helping to accomplish just that.

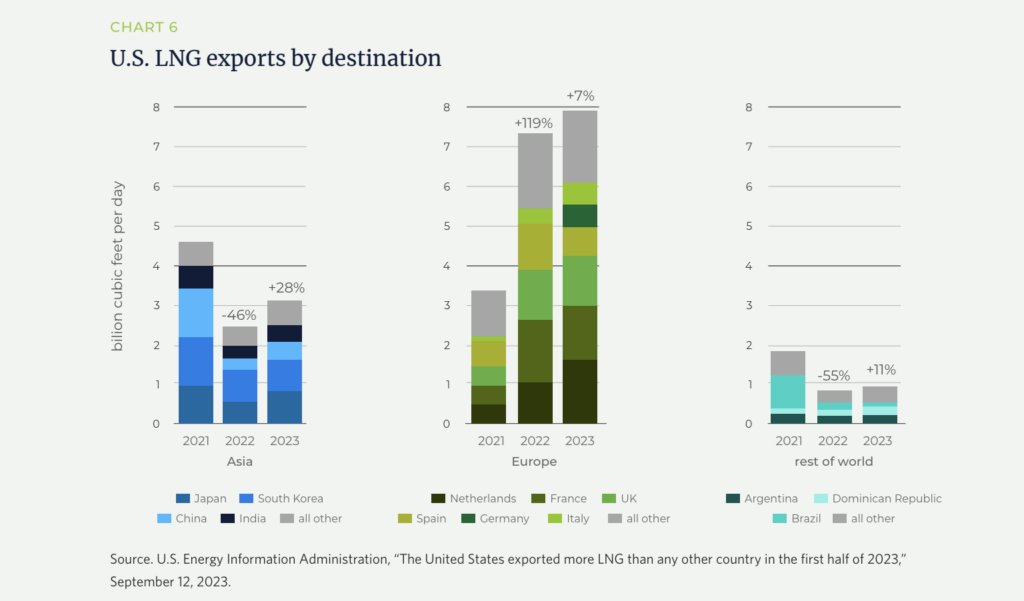

Europe has been dependent on Russian natural gas for far too long, but Russia’s invasion of Ukraine prompted a more concerted commitment to diversify. American energy producers have stepped up in a big way to fill that need. In 2023, two-thirds of U.S. LNG exports went to Europe as European countries continued to expand import capacity. Diversified supplies combined with mild winters have helped lower energy prices throughout Europe and helped countries build up gas inventories quicker than previously expected.

The G7’s April 2024 Climate, Energy and Environment Ministers’ Meeting Communiqué emphasized that “restricting Russian energy revenues is an essential part of our support to Ukraine and are pursuing to end significant dependency on, and to work on transitioning away from imports of Russian gas as soon as possible. In this context, we stress the important role that increased deliveries of LNG can play and acknowledge that investment in the sector can be appropriate in response to the current crisis and to address potential gas market shortfalls provoked by the crisis.”

On a recent visit to Washington, D.C., Maros Sefcovic, Executive Vice President of the European Commission, put it simply: “The U.S. is now the guarantor of global energy security.” That is unless bad policy gets in the way.

The Biden Administration’s Export Pause

In addition to the Federal Energy Regulatory Commission’s permitting requirements, LNG projects are subject to a public interest determination under Section 3 of the Natural Gas Act. The public interest language is very vague and provides subjective authority for DOE to determine what can and should be consistent with the public’s interest. Several studies evaluating the public’s interest, including ones conducted for the DOE, have mostly focused on economic costs and benefits. Notably, the NERA study conducted for the DOE concluded that unlimited LNG exports would have higher net economic gains than scenarios with limited exports. While DOE immediately authorizes exports to recipient countries that have a free trade agreement (FTA) with the U.S, most countries receiving U.S. LNG do not have such agreements in place.

On January 26, President Biden announced a pause on pending LNG export decisions so that the Department of Energy can update its analysis for authorization. When pausing the exports, the administration said it would review pending applications on their environmental and climate impacts as well as their price effects on domestic energy consumers and manufacturers. In addition, administration officials, advocates of the pause, and even some EU parliament members have stated that the U.S. has sufficiently supplied European allies with LNG and those countries will not need additional commitments to replace Russia’s supply. Each concern has questionable logic and moreover fundamentally misunderstands the role of the market in determining the appropriate level of LNG exports.

The Climate Impact of Halting LNG Exports

Several analyses have conducted lifecycle emissions of LNG compared to other forms of energy and found LNG to be cleaner than coal and Russian-piped gas, even with fugitive methane emissions. A 2019 DOE analysis estimated that LNG exports can have lifecycle emissions up to 54 percent less than coal if going to Asia and up to 56 percent less if headed to Europe. When compared to Russian-piped gas traveling to Europe, U.S. LNG is 41 percent cleaner. In 2015, an analysis published in Environmental Science & Technology similarly found emissions reductions when U.S. LNG displaced coal and Russian gas.

A more recent study conducted by Berkeley Research Group (BRG) examined the greenhouse gas footprint of U.S. LNG compared to coal and Russian gas for power generation. The analysis, published in April 2024, looked at 906 LNG cargoes traveling to thirteen countries in Europe (eight) and Asia (five) in 2022. BRG found:

- Coal power generation had more than double the emissions intensity compared to U.S. LNG going to Europe and Asia.

- Russian piped gas to Europe was one-third more emissions intense compared to the U.S., but LNG piped gas from Norway is cleaner (three-quarters of the GHG footprint) than American exported gas.

- Piped gas from Russia to Asian markets was slightly more emission intensive than U.S. LNG and more than four times higher if the pipeline gas came from Turkmenistan.

Even after accounting for fugitive methane emissions in the U.S., the climate benefits from natural gas are clear. Methane is a powerful greenhouse gas, it does not accumulate in the atmosphere like carbon dioxide does. As the Breakthrough Institute’s Ted Nordhaus explains, methane’s “warming impact is very short term and transitory. Today’s methane emissions simply can’t significantly affect the climate that future generations will inherit because, except for the very tiny amount of residual carbon dioxide it leaves behind, it is gone from the atmosphere within 20 years.” While some studies have suggested that methane leakage makes LNG no better than coal, those studies assume high fugitive emissions and look at shorter timeframes than the more typical 100-year time horizon for global warming potential.

Surely if renewables, nuclear or geothermal power displaces coal or Russian gas, the emissions gains would be even greater. The larger problem, however, is that environmental activists object to any new hydrocarbon infrastructure, even if there are emissions reductions on net. As Matt Yglesias pointed out, “The actual revealed preference of the climate movement is to take an arbitrary hammer to any fossil fuel project that they see, in such an arbitrary way that they want to do it before even knowing whether the project raises emissions.”

Opponents of LNG projects do not want to allow any more fossil fuel infrastructure for the next several decades. Not only does this thinking ignore energy demand realities, but it also weighs emissions effects in a vacuum without considering tradeoffs. Europe and the rest of the world are going to need more energy, and by all accounts, it will be an energy expansion rather than an energy transition. Even assuming greater emissions from U.S. LNG exports, one must consider the benefits of expanded energy access, higher levels of prosperity globally, economic opportunity for Americans, and greater energy security for Europe.

The Price Impacts and Economic Benefits at Home

Another concern raised by the Biden administration is how LNG exports will affect domestic natural gas prices and energy consumers. Economics 101 tells us that if supply remains constant, expanding the population of buyers of LNG will shift the demand curve and raise prices. A February analysis from Energy Innovation Policy & Technology LLC estimates that completing the pending LNG export projects could raise natural gas prices 9 to 14 percent. To put that in perspective, a house that relies on natural gas for home heat would pay an additional $1.67 to $3.33 per month. Importantly, the study notes that the exact costs on families and industry “may moderate as producers adjust output to demand.” Markets are not static. Higher prices will spur new production. Technological innovations have driven more efficiencies in the industry, making more recoverable resources economically viable even at lower prices.

Other analyses have shown that increased exports have had minimal impacts on domestic natural gas prices. A March 2024 Energy Ventures analysis, commissioned by the American Petroleum Institute, showed that the six-month average of Henry Hub natural gas prices at the beginning of 2023 were the lowest in 35 years even as LNG exports reached record levels. The authors attribute the negligible price effect on short-term domestic natural gas prices to lengthy construction times and long-term financing and contract structures. These factors provide a long lead time for the market to react before the LNG reaches the market. Specifically, the report says:

The lengthy project development process gives U.S. natural gas producers sufficient time to increase output to feed the new LNG export projects. As a result, the U.S. natural gas market already has accounted for the increased demand from a new LNG export terminal by the time the project is completed and loads its first vessel. Also, due to the long-term contracting nature for most of the scheduled LNG export volumes, the nominal natural gas flows to the new terminal are highly predictable and, therefore, priced into the U.S. natural gas market, resulting in little to no increase in domestic natural gas prices.

It is also worth repeating and underscoring the 2019 DOE study that said the net economic benefits would exceed the costs in the case of unlimited LNG exports versus limited ones. Nevertheless, even if LNG exports did cause a sufficient increase in domestic natural gas prices, this does not give the government reason to intervene.

First, the federal government does not own the natural gas. Unless there is a national security concern, U.S. companies should be able to freely trade goods around the world. The government should not limit natural gas exports any more than it should limit exports of cars, clothes, or corn. Moreover, government intervention distorts the critical role of prices. Higher natural gas prices would not only incentivize more domestic production, but they could also incentivize investments in other power generation sources, such as nuclear, geothermal, or battery storage. Prices communicate information to the market far better than government officials. Arbitrary public interest determinations should not stand in the way.

Does Europe Need More American LNG?

Based on most projections and forecasts, the world is going to need more natural gas. Growing populations in Africa, India, and Asia and the rise of artificial intelligence could drive strong energy demand over the next several decades. In the high economic growth case, for instance, the EIA projects global demand for natural gas could increase as much as 57 percent by 2050. Even under less ambitious economic growth scenarios, natural gas remains a staple of the world’s energy mix.

Yet, as Europe continues to decouple from Russia, advocates of the LNG export pause, including Biden administration officials, have suggested that Europe will be well supplied with current exports and projects under construction. In one interview, U.S. energy envoy Amos Hochstein said the administration is examining what global demand looks like, ensuring that the U.S. does not overbuild capacity. Other energy analysts have similarly remarked that expansions of renewable and energy efficiency projects mean that additional LNG commitments are unnecessary.

If that is the case, then there would not be a need for the pause in the first place. Investors are pouring hundreds of millions of dollars into these projects with the expectation that global demand for natural gas will be strong. If those businesses and investors are wrong, they will bear the loss. Businesses make bad investments all the time, sometimes very costly ones. The federal government cannot tell the market what the appropriate quantity of global LNG will be next week, next month, or next year. Instead, the government’s appropriate role is to ensure that proposed projects meet the necessary environmental requirements.

The reality is energy producers do not know what demand will be over the next 25 years, let alone the demand for LNG. But that is even more reason not to ban future projects. As Dan Byers, Vice President for the U.S. Chamber’s Global Energy Institute wrote, “The broader takeaway we should all agree on is that natural gas demand outlooks are complex and highly uncertain. Politicians, regulators, and modelers can all speculate, but the market speaks loudest, and it is doing so in the form of long-term multi-billion-dollar contracts for U.S. LNG.” In the nearer term, the administration’s pause is clearly harming relationships with America’s partners in Europe and Asia. Some of the affected projects could have come online within the next few years and have entered long-term contracts with Germany, the United Kingdom, Japan, and other allies. The longer the pause continues, the more it will jeopardize Europe’s plan to end its energy dependence on Russia as quickly and cost-effectively as possible.

Time to Press Unpause

U.S. LNG exports have been a tremendous boon to the economy, strengthened relationships with America’s allies and can be imperative to meeting the world’s energy needs and environmental ambitions. The Biden administration’s LNG export pause is bad policy and bad politics. The economic, and environmental rationale for the decision is weak. More fundamentally, the government should not usurp the market’s role in determining how much LNG American companies export. It is far past time for President Biden to press unpause.